New year, new challenges. April sees the new accounting standard for financial instruments, IFRS 9, come into force for councils. Peter Worth reveals the way to get ready.

New year, new challenges. April sees the new accounting standard for financial instruments, IFRS 9, come into force for councils. Peter Worth reveals the way to get ready.

IFRS 9 comes into effect on 1 April 2018 for local authorities, affecting comparative disclosures for 2017/18. It aims to improve financial reporting through:

- New asset classes for financial instruments.

- Wider application of “fair value” measurement (IFRS 13).

- Earlier recognition of impairments.

Local authorities with shareholdings in limited companies are likely to be affected by the new requirements. Three key actions are necessary.

1. Reclassification

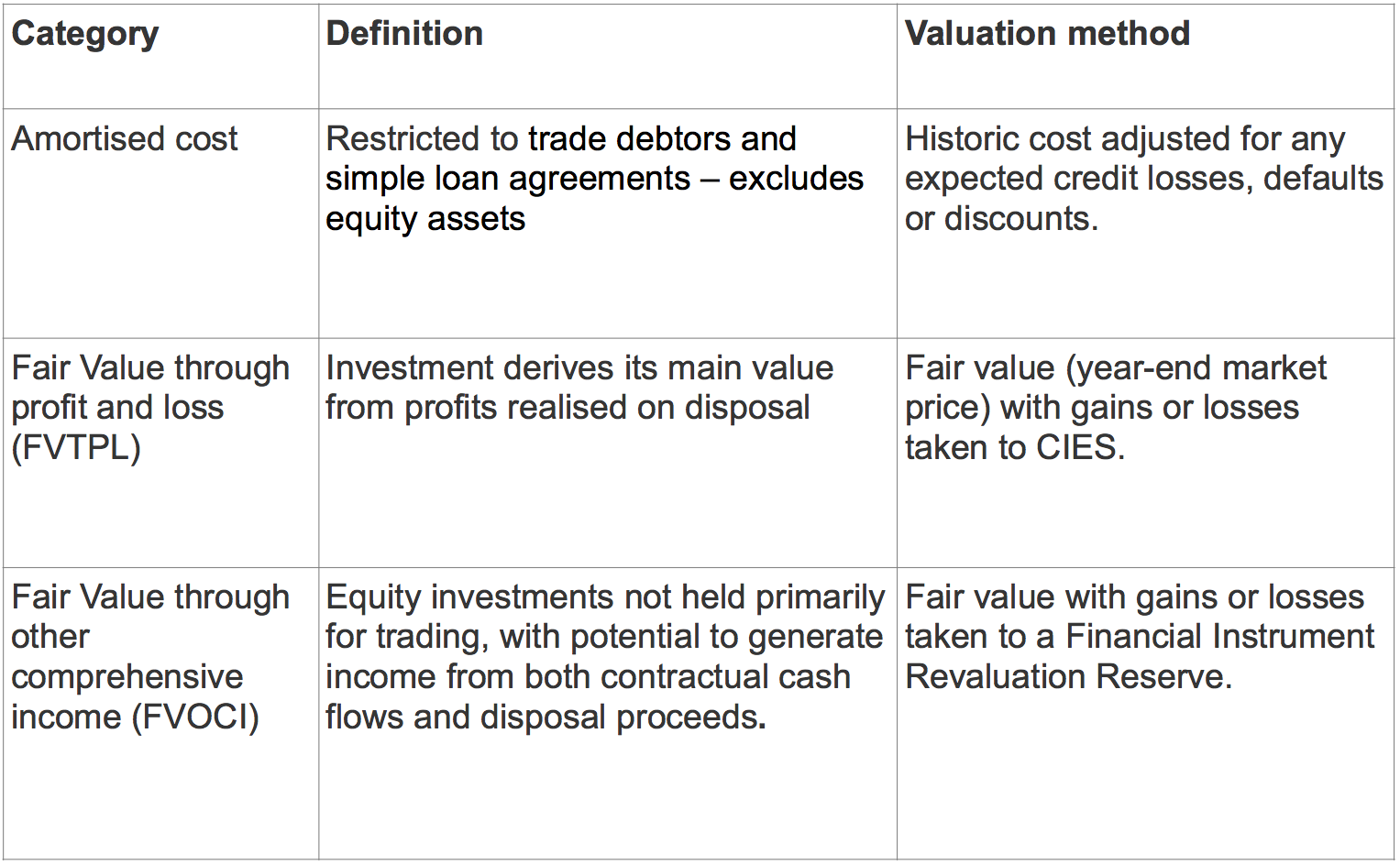

IFRS 9 replaces existing classes of financial instruments with three new categories (shown below). Equity shareholdings will need to be categorised as either FVTPL or FVOCI since the “available for sale” class previously used by most authorities no longer applies.

Classification depends on the purpose for holding the asset, but most local authority companies express this in terms of operational or strategic aims, not financial outcomes. Even when companies are set up specifically to generate additional income, business plans and exit strategies can be unclear, with entities taking longer than anticipated to generate hoped-for returns.

Shareholdings will therefore need to be reviewed before reclassification can take place, with a clearer focus on:

- Financial performance and expected returns.

- Whether investments are held for strategic or commercial purposes.

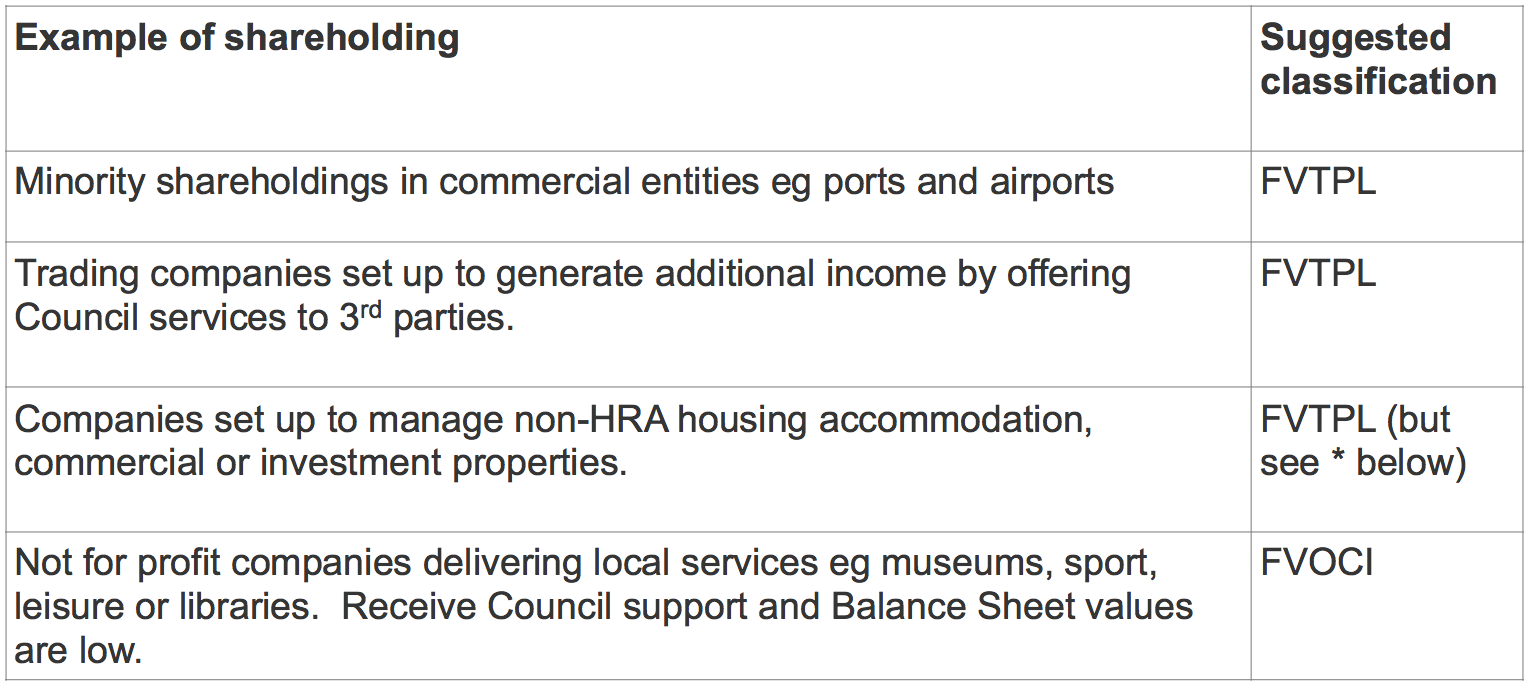

Care should be taken as subsequent re-categorisation, although possible, is not expected to be routine. Examples of how some common types of shareholding might be categorised are:

Note: The Code permits authorities to “designate” a FVTPL asset as FVOCI, deferring the recognition of gains and losses to the CIES until they have been realised on disposal. Authorities would need to demonstrate that the holding was for a strategic purpose (eg. economic development), not just investment return.

Local authorities can also “own” (by controlling) companies limited by guarantee (eg housing ALMOs), or unincorporated charities. Such companies do not have equity, consequently fall outside the scope of IFRS9, and may be a more appropriate vehicle for limited companies unlikely to generate future returns.

2. Valuation

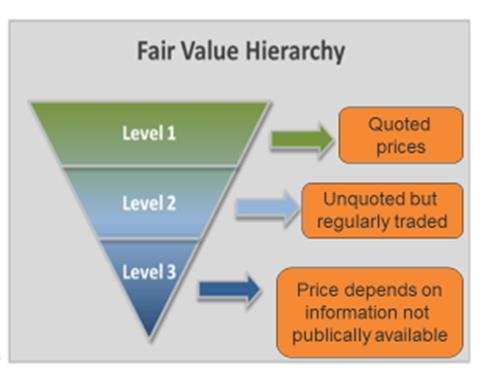

The Code no longer permits unquoted equity investments to be held at cost so local authorities will need to obtain fair values for all shareholdings. Since most are not listed or regularly traded, assessing fair value is often a matter of practitioner judgement although an independent expert can be engaged to assist.

IFRS 13 requires organisations to use valuation methods appropriate to the circumstances, but a range of options are permitted based on either net asset values, expected profits or future income streams. Whichever method is adopted will need to be disclosed in the accounts, together with analysis in terms of the Fair Value level 1-3 hierarchy (see below), a description of significant valuation inputs and a sensitivity analysis (level 3’s only).

3. Impairments

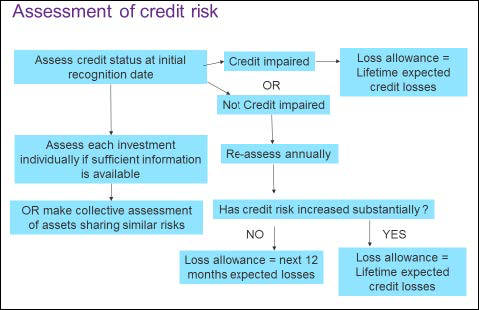

Another change under IFRS9 is that authorities must recognise impairment of assets at inception rather than wait until an actual loss occurs. This means that:

- Any loans to companies will need to be assessed for the likelihood of non-payment at the lending date and throughout the life of the loan.

- All equity investments held at fair value will need to be considered for impairment at the outset and monitored annually.

The Loss Allowance will then be carried forward in the Balance Sheet, with a charge to the CIES each year representing the movement in net expected losses.

This is a major conceptual change which may focus attention on entities where impairments will need to be recognised if the Council does not provide additional financial support. Practitioners will need to document:

- Impairment calculation methods and all key assumptions made.

- The rationale for continuing to hold the investment.

So far there is no statutory override in place to prevent impairments representing a real charge against council tax, so authorities will need to build forecasts into revenue budgets requirements for 2018/19 and beyond.

Peter Worth is a director at Worth Technical Accounting Solutions.