CIPFA is reportedly working on a statutary override for the controvesial accounting standard IFRS9. Peter Worth argues there are plenty of reasons why this is unnecesssary.

CIPFA is reportedly working on a statutary override for the controvesial accounting standard IFRS9. Peter Worth argues there are plenty of reasons why this is unnecesssary.

Introduced on 1 April, IFRS 9 now covers all equity investments. These include counterparty loans, cash deposits, purchased share capital and pooled investment vehicles, though not directly held property or shareholdings subject to group accounts.

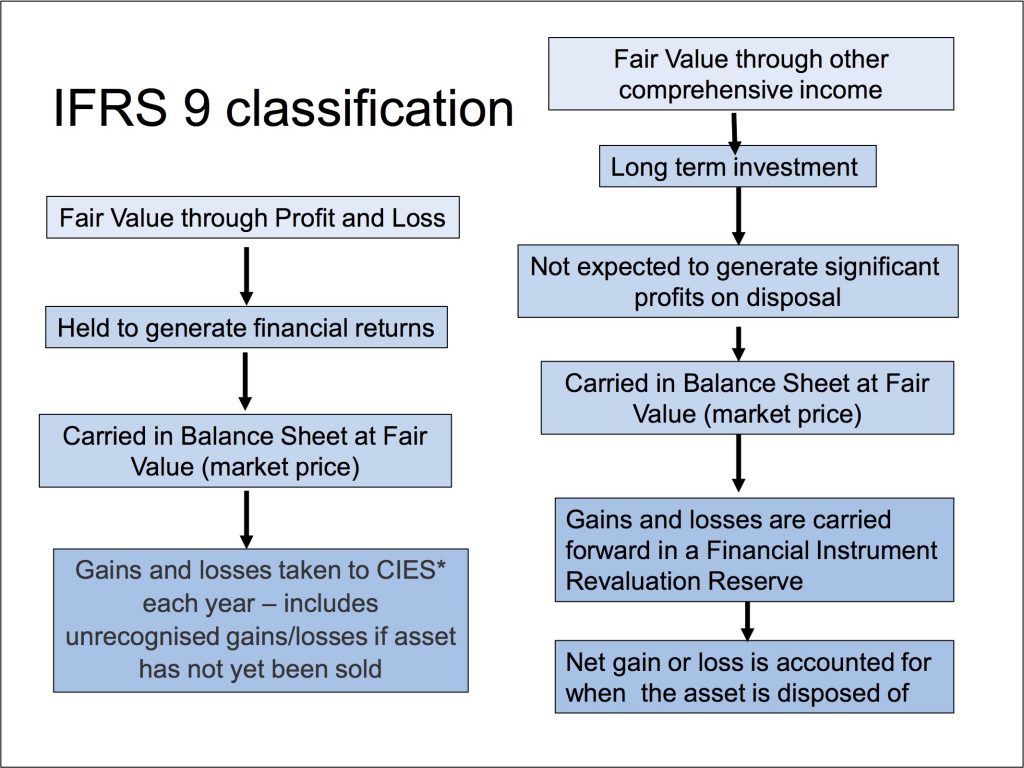

The new standard requires equity investments to be classed as either “fair value through profit and loss” (FVTPL) or “fair value through other vomprehensive income” (FVOCI).

Both are valued in the same way under IFRS13 but classification determines whether unrealised losses or gains are taken straight to revenue or held in reserves until the asset is disposed of:

According to “Public Finance”, CIPFA is working with central government on a statutory override to ensure that any unrealised losses on FVTPL investments will not affect the taxpayer.

One of the arguments supporting the override is that some investments initially decline in value before they recover, the so-called J-curve effect. This often reflects front-loading of fees and transaction costs particularly relevant to some types of collective investment vehicle.

Many practitioners consequently expect the override to be restricted to these investment options only, but I do not consider it right that either legislation or accountancy should favour one type of instrument over another in a way that might influence treasury management decisions.

Moreover, IFRS13 specifically states that fund managers’ fees and transaction costs should be expensed and not deducted from the value of investments.

Proper application of existing requirements would thus avoid the need for any impairment or reserve accounting.

No override required

There are another four reasons why I believe an override for IFRS9 is not required.

1. IFRS9 already permits reserve accounting

IFRS9 allows equity investments to be classified as FVOCI where the investment exists for purposes other than simply to generate financial gains.

Even without an override, many local authority investments can therefore be classified in a way that permits reserve accounting.

2. Transparency and accountability

New Statutory Guidance published in February 2018 requires greater transparency on local government investment returns and the extent to which core services depend on investment income. One way of achieving this is to align service expenditure with the relevant investment transactions in financial statements.

A statutory override reversing these transactions will only lead to less transparency and could camouflage poor decision making.

3. Consistency with LGPS accounting

Local Government Pension Scheme accounts have always reflected the full change in market value of investments in the Funds Account each year, and since 2014/15 they have been encouraged to treat all fees and transaction costs as expenses.

This practice will continue under IFRS9 and to maintain different accounting treatments for their administering authorities seems both illogical and unnecessary.

4. Track record on investment returns

Although I understand the desire to protect reserves and council tax levels, I also believe that local authorities usually make good investment choices.

Recent track records on pension investment portfolios are impressive, with a 25% increase in fund values over the past three years, and most local authorities have recently demonstrated, as part of the MIFID II “opting up” process, that they have sound arrangements in place to understand and manage investment risk.

Consequently, I remain unconvinced of the need for a statutory override in this instance. Also, setting technicalities aside, local authorities struggling to balance budgets in the eighth consecutive year of austerity might find the option to access investment gains earlier than expected extremely useful.

Peter Worth is a director at Worth Technical Accounting Solutions.