Alternative investments are growing in popularity. Elizabeth Carey explores what they are and why they’ve become a must-have.

Much has been written about the growing appetite of institutional investors—and specifically LGPS funds—for so-called “alternative” investments. Alternatives include such a broad range of asset classes and strategies that it is often easier to define by what it is not: Alternatives are not long-only listed equities, bonds or real estate holdings.

Earlier incarnations of alternatives were typically private equity buyout funds or else hedge funds that took active trading positions in the direction of rates, yield curve shapes, swaps and derivatives, currencies, volatility pricing, credit derivatives, REITs, commodities, EM debt, real estate secured debt, securitisation, long-short equity trading, short selling and convertible bond arbitrage.

From Niche Product to Mainstream Allocations

Institutional investors in the US have invested in alternatives since the 1970s. Their early adoption underpinned the growth of many hedge funds, which subsequently become household names, including Tudor Group, George Soros’ Quantum Fund, Moore Capital and Millennium Management.

Diversified growth funds (DGF), also known as “multi-asset” funds, sprang up to offer portfolios of hedge fund-like trading strategies, which their managers nimbly shift to express constantly evolving trade ideas. Some of the early DGFs date from the early 2000’s.

UK institutions and specifically the LGPS began to embrace alternatives after the market sell-off during the Great Financial Crisis (GCF) between Q3 2008 and Q1 2009. During this period, many DGFs performed better than portfolios of long-only equities or sub-investment grade credit. The GFC market panic likely persuaded many LGPS fund managers (with assent from their consultants and advisors) to diversify away from equities into alternatives.

DGFs became an alternatives gateway for some LGPS, leading them into less liquid strategies.

A positive marketing story of “protecting investors” during the crash made DGFs an easy first port of call for LGPS seeking to reduce equity risk, yet remain invested in return-seeking assets. DGFs became an alternatives gateway for some LGPS, leading them into less liquid strategies. Fund-of-fund structures helped some LGPS authorities achieve diversification within their alternatives allocations, whereas other LGPS funds with larger in-house teams evaluated alternatives strategies, selected managers and invested directly.

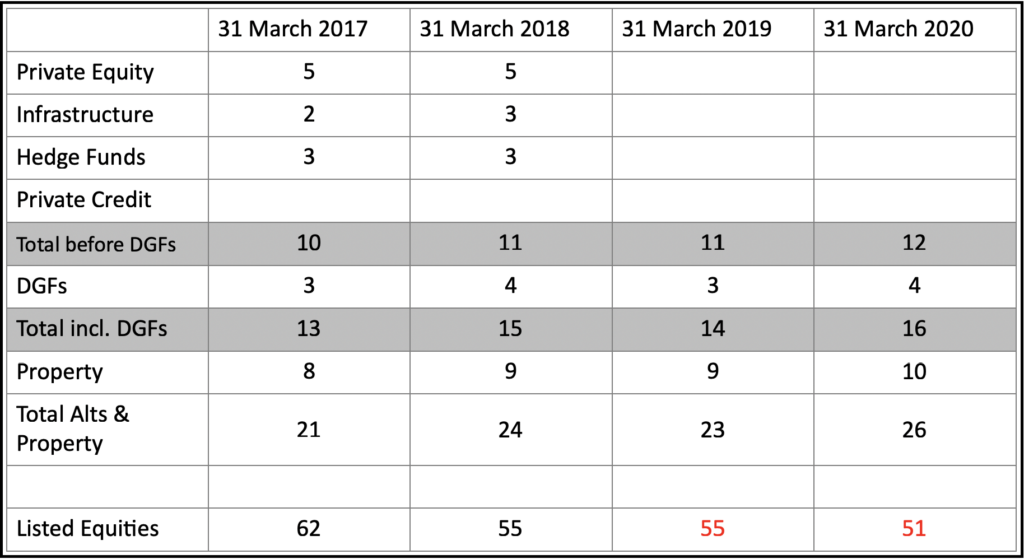

PIRC (Pension & Investment Research Consultants) have published data through March 2020 based on 63 LGPS funds holding assets totalling £180 BN. According to PIRC, less liquid alternative assets (private equity, hedge funds, private credit and infrastructure) rose from 9% of assets at 31 March 2011 to 12% at 31 March 2020. Over the same decade, DGFs rose from around zero to 4% by end March 2020. This growth in DGFs and less liquid alternatives, from 9% to 16% of LGPS funds came at the expense of listed equities, which fell from 64% to 51% over the same period.

It should be remembered that the assets of LGPS funds have risen sharply over the last decade along with their allocations to alternatives, so in absolute terms, the growth of LGPS capital invested in alternatives will be greater than these percentages suggest.

Furthermore, strategic allocations to less liquid alternatives are typically higher than actual cash invested in them because of delays between committing capital to a fund and that capital being “called” for deployment. For this reason, the actual (funded) alternatives exposure of LGPS funds is likely to understate their aspirations, which is better reflected in commitments made or strategic asset allocation targets.

29th November, 2021

London Stock Exchange

6th Annual FDs’ Summit

Lead sponsor PFM/UKMBA

Public sector finance directors can register here

The Attraction for LGPS: Returns with diversification

The attraction of alternatives is largely their perceived higher returns with lower volatility versus publicly traded debt and equity. Alternatives, like distressed debt or private credit funds, may offer current yields above what is available on sub-investment grade bonds in today’s market. LGPS funds seeking current cash flow turn increasingly to alternative credit or rentals-based strategies.

Alternatives’ extra return, whether in the form of current distributions or capital gains, is sometimes referred to as the “illiquidity premium” because of the longer holding period required to realise the value of many investments versus more liquid (i.e., tradable) shares or bonds.

Of course, the net return to the investor must always be analysed to see what portion of that illiquidity premium was “spent” in terms of manager fees to deliver the return. A cold, hard view of the allocation of benefits between the investor and manager must be part of the analysis of any alternative strategy.

Alternatives are widely perceived to diversify investment risks. In many cases, this perception may be true, but it is important to analyse each underlying strategy along with its return drivers and risks.

The attraction of alternatives is largely their perceived higher returns with lower volatility versus publicly traded debt and equity.

Private equity may offer diversification within equities, but it is unlikely to diversify risks or return sources away from equities. This is because valuations in the listed equity markets drive pricing and ultimately exits for most private equity holdings.

Similarly, in the bank loan market, the pricing (i.e., yield spread) of larger, broadly syndicated loans has been driven down by rising allocations to this sector. Consequently, the illiquidity premium may be vanishingly small, while the asset class can still suffer a steep fall-off in price under a flight to quality scenario, such as happened in March 2020.

Recently, LGPS funds and their pools have added “liquid alternatives” to their range of alternatives strategies. So-called “liquid alternatives” include listed REITs, listed infrastructure and renewable energy funds, master limited partnerships (holding oil and gas pipelines) and listed credit funds.

Alternative ways to support Sustainability and ESG Priorities

Another recent trend is alternative funds that invest thematically in sustainable “real” assets such as housing or infrastructure businesses. Such alternative funds provide development capital for projects at various stages of technical or market maturity.

Examples include renewable energy installations, food production facilities with lower environmental externalities, ventures for reprocessing waste, or turning waste into energy, broadband rollout platforms, healthcare and education facilities, or even schemes for cultivating naturally-occurring carbon sinks.

A venture capital mentality may be well-suited to such new business models where “proof of concept” is an important first step before a more sustainable operation can be prudently rolled out in larger scale.

Alternatives have become a core allocation within most LGPS portfolios, sitting alongside equity and fixed income.

With the strong focus on stewardship, engagement and TCFD metrics, certain types of alternative investments may be well-suited for LGPS transparency needs. Funds that hold controlling stakes in a company, or operating asset, may facilitate positive engagement on relevant ESG themes. Managers of such funds are in a strong position to demand changes in operating practices to make investee companies more sustainable, less polluting, less wasteful, less CO2-intensive, more responsive to the communities where the business is located, and generally better corporate citizens.

LGPS funds and some pools have begun engaging with a broad range of alternative investments that may be able to deliver acceptable risk-adjusted returns, while also demonstrating higher accountability on the sustainability and ESG front.

Alternative investment strategies have evolved significantly over the past five decades. Alternatives have become a core allocation within most LGPS portfolios, sitting alongside equity and fixed income. Given this growth in size and scope it is no surprise that LGPS pools are prioritising the build-out of their alternatives offerings to meet rising demand from member funds.

Elizabeth M. Carey, CFA, works as an independent advisor and research analyst for local government pension schemes. She spent much of her previous career working in corporate finance and capital markets in New York and London, and subsequently worked as an in-house M&A banker for GE Capital in London. The views expressed in this article are her own.

Photo by Ruchindra Gunasekara on Unsplash

—————

FREE monthly newsletters

Subscribe to Room151 Newsletters

Room151 Linkedin Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel