An annual report containing no big news but illustrating significant change since 2012, writes William Bourne.

March 2020 was a dramatic moment in the world as it came to terms with the implications of the lockdowns imposed across much of the world. In contrast, the 2020 LGPS report and accounts on the same date was remarkably undramatic.

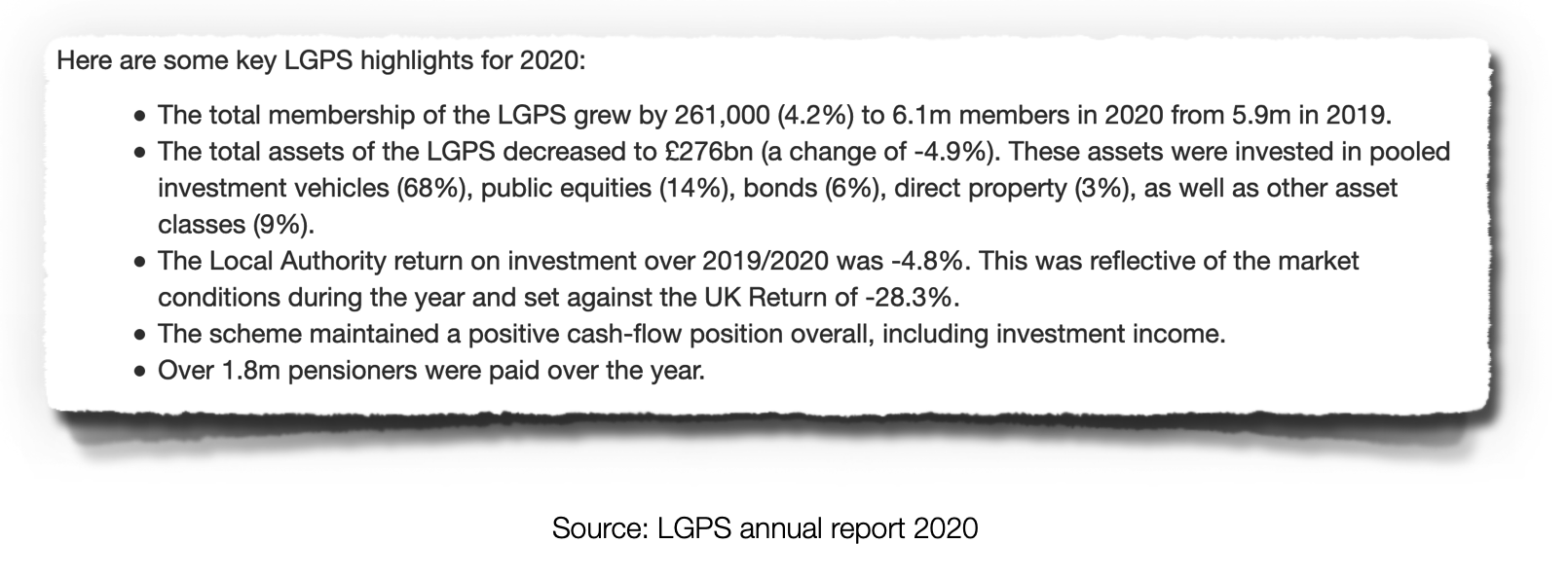

It recorded an annual 4.8% drop in assets, the first since 2009, and a funding level of 85% compared to 98% at the 2019 actuarial valuation.

However, most of the metrics continued in the right direction and the market has of course rebounded since then.

In the absence of drama, I shall reflect on some details from the 2020 report and compare them with the numbers in 2012, which are extractable from the Scheme Advisory Board’s first report in 2013.

16 November 2021

London Stock Exchange or ONLINE

Room 151’s LGPS Investment Forum

Our annual gathering of administering authorities of the LGPS, their investment pools and advisers.

Qualifying local government investment officers can register here.

Comparisons

There are now 6.2 million members of the LGPS, a 30% increase compared to 2012, and 16,300 employers, an 80% increase. That means that something like 10% of the entire population of the U.K. is a member in some way of the LGPS.

The sheer scale has added to the complexity of administration caused by increased and changing regulations, as has the fact that many new employers, such as academies, are smaller and less well resourced.

That is all without the various other curveballs (guaranteed minimum pensions reconciliation, GMP, McCloud, exit caps etc) thrown at the scheme by the government and the law-courts.

In 2012, before pooling, funds held around 60% of assets directly and 40% through pooled vehicles. In 2020 only around a quarter of assets are held directly, reflecting the march of pooling and the increased allocations to passive investments and private assets.

However, investment management expenses have risen from £0.4bn to £1.29bn over the same period.

£0.3bn of this increase is accounted for by the 72% rise in the LGPS’s assets under management, as most investment fees are charged on a pro rata basis.

But one of the “wins” from pooling is supposed to be lower investment costs. I assume this increase in investment expenses is coming from allocation away from fixed income to more complex and expensive assets, and perhaps a higher level of performance fees in private assets. If I am wrong, pooling has not yet driven the fee reduction benefit which was one of its main purposes.

Administration, oversight and governance costs have risen from £0.14bn to £0.22bn over the same period. Some of this is coming from the increase in membership and employers. But most has been driven by higher data quality expectations and the cost of dealing with the various curveballs I mentioned earlier.

Costs

Looking forward, there will be further costs as the Pension Regulator tightens its focus on data and governance. I am already seeing a trend at funds to add resources to deal with this. It is also worth keeping an eye on the rising cost of administration software, where there is an effective oligopoly. New challengers in this area would be helpful.

The Scheme Advisory Board also lists fund and pool signatories to the Stewardship Code and the UN Principles of Responsible Investment (PRI).

Given the emphasis on responsible investment, it is surprising that only thirteen funds are signed up to PRI and that only three have done so in the past five years.

three have done so in the past five years.

In 2020, 28 funds and four pools were Tier 1 signatories to the Stewardship Code. Again, I find that number surprisingly low, given that it is virtually mandatory to follow it.

The explanation may be that funds are relying on pools to invest responsibly. While this is rational, 25% of assets remain directly held by the funds, and they retain ultimate accountability.

I also note that the incoming legislation in areas such as climate-related disclosures will fall on asset owners as well as managers.

Crystal ball

The LGPS is used to dealing with challenges, and I doubt the future will be very different. If I were to use a crystal ball to predict what the 2030 annual report would look like, I would expect some of the following:

*

- Almost all assets will be pooled in some form;

- consolidation will lead to a lower number of funds and, particularly, pools;

- membership and complexity will continue to rise;

- so will costs despite best efforts to keep them down;

- investment returns will be much lower than the 7% achieved in the past eight years, even though March 2020 was almost the bottom of a bear market.

Perhaps most relevantly, a great many more funds will find ways to signify their desire to invest responsibly.

The report might, for example, include an aggregated carbon footprint to track progress towards carbon net zero at Scheme level.

As an aficionado of LGPS valuations, I shall look forward to the next instalment, the Section 13 valuation by the Government Actuarial Department, which is due in the autumn.

William Bourne is principal of Linchpin Advisory Limited and has roles with five LGPS funds.

Photo by Danie Franco on Unsplash

—————

FREE monthly newsletters

Subscribe to Room151 Newsletters

Room151 Linkedin Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel