Jason Fletcher, former CIO of the LGPS pool London CIV, makes the case for more joined up thinking in pension and economic policy in order to attract more investment in the UK whilst delivering better returns for younger pension savers.

Jason Fletcher, former CIO of the LGPS pool London CIV, makes the case for more joined up thinking in pension and economic policy in order to attract more investment in the UK whilst delivering better returns for younger pension savers.

The two biggest challenges that the UK economy faces right now are stale productivity and an escalating pension problem. Back in 2003, Britain had a booming economy and one of the most admired pension systems in the world. Today we are facing anaemic economic growth, a generation with low pensions and unfunded pension liabilities compounding, weighed down by the triple lock.

Where did it all go wrong? How do we get back to economic growth and security in retirement? Which policies, nudges and incentives do we need to put in place to make sure the next 20 years are a little more rewarding?

Productivity laggard

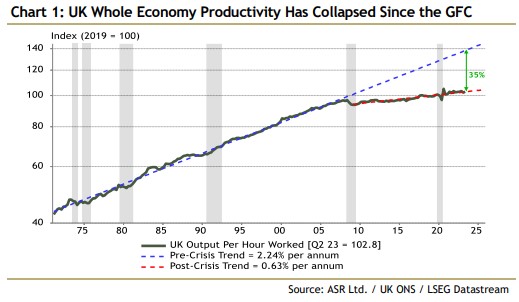

When it comes to productivity, UK output per hour worked has expanded at a measly 0.6% since 2008, versus 2.2% over the previous 40 years. (pictured starkly by Absolute Strategy Research Ltd below) The chancellor thinks it is due to high taxes and low investment as seen in the measures taken in his Autumn budget statement (note the 6-month budget cycle).

The UK currently sits on the 78th percentile in the investment to GDP table at only 18.5%. Across the big pond the US, are on the 82nd percentile but have seen far superior productivity over the last 20 years. The investment secret source is not about the size invested but the quality of those investments. That means return on investment being above the cost of capital, adding value, profit, or a good outcome over the long run.

We must look beyond the end of the current financial or political year with an election round the corner. It took decades to turn a profit on the invention of planes, trains, or the internet. This investment holding period is misaligned with the accounting cycle (1 year in arrears), political cycle (3-5 years), economic and business cycles (8-10 years), or sadly even the newly shortened pension investment time horizon.

Underfunding

Pensions in the last 20 years have moved from Defined Benefit (DB) plans with high risk-return, low cost, and long-term investments to Defined Contribution (DC) plans with low risk-return, high cost and short-term investments. Meanwhile, we have seen the contribution rates (the percentage of salaries paid into pensions) from employers/government drop from 20% to 6% typically. The employee has continued to put in 6% contributions but when they are wearing the full risk they tend to opt or default to safer low risk-return investments and do not get the collective cost savings of the larger plans.

Government policy has focused on consolidating pension pots and “nudging” more investing in UK private markets through the mansion house compact, energy transition, Levelling Up policy and more investment in “productive” capital. Unfortunately, regulation, risk managers, lawyers and accountants have all been pushing pensions funds in the opposite direction. All in, pensions for the millennial generation will be only a third of those that the current boomer and x generation will get in retirement.

Corporates, sponsors, and government policy have aided and abetted these lower contribution rates and the decline in DB pensions. We did this to boost short term profits and fiscal balances but has left taxpayers with a pensions time bomb. Meanwhile the state pension and the unfunded public sector (NHS and teachers’ pensions) have swelled for future taxpayers to support in the future. Furthermore, the move to DC has seen a reduction in the risk-return mix of pension pots. Shocking to see that average millennial (aged 27-42) has 45% of their pension invested in bonds according to Charles Schwab. Are bonds the best place for someone to park money when they are hoping to retire in 30 years time?

Being bold

We clearly need bolder policy making.

To be bolder in economic terms means taking on more risk-return projects in affordable housing, education (skills), health (healthier people are more productive) and the energy transition. We need to ensure that capital spending is complementary to, not competing with the US Inflation Reduction Act (IRA) unless someone has $369bn stuffed behind the sofa. Supporting start-ups and small businesses is vitally important as this is where employment and growth will be in the future.

To be bolder in pensions terms means encouraging long-term, higher risk-return taking, more mandated contributions and less mandated investments. Simplicity would be welcome, with less options, providers, complex taxes and allowances and less liquidity options in DC. With this stability and security asset owners will take on more risk-return and invest in what the government would like us to all invest in.

The hurdles we need to cross to get to a better place include gatekeepers (taking advantage of current pensions and business complexity without necessarily adding value) and the cost of doing business (property costs, planning permission, regulation not tweaking taxes and allowances).

Regulation, British conservatism, and our risk minimising mindset also need a hefty nudge. We need to resolve the debate over private versus public investment and greenwashing and focus on the re-equitisation into productive capital.

Key enablers to better pensions and productivity include promoting champions (Pension Protection Fund, British Business Bank, larger DC and DB plans and those looking to consolidate Pension funds), long-term thinking and responsible risk-return taking. All political parties and pension providers should be involved but all should remember that pension funds will certainly outlive their term in office and their time on this earth.

What the next generation needs is long-term, joined-up thinking from politicians, economists, investors, and regulators. Larger funds and long-term funds invest more in productive capital so should be incentivised. Mandating higher contributions, limiting portability, proper customer risk-return assessments and encouraging DB plans or similar risk sharing variants would all help. For me, the 2% cut in national insurance just announced in the autumn statement should be ploughed back into pension contributions to be invested into “productive” capital.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel