Sponsored article: James Penney looks at an investment in helping councils provide high quality bereavement services.

Nothing is certain but death and taxes said Benjamin Franklin and as a result, bereavement services are a key part of local authority infrastructure. The continuing pandemic has thrown into sharp focus both the importance of this core social infrastructure as well as the increasing shortage of supply, especially for burials.

There is a crippling lack of supply of burial space, with many councils’ cemeteries close to full capacity, and the rising trend in the UK deaths rate, which is anticipated to continue for the next 20 years, will only exacerbate this. Of course, we all know from government press conferences that there have been considerable “excess” deaths over the past fourteen months, but nevertheless the demographics still point to a gradual increase in the death rate for the next decade or so.

16 November 2021

London Stock Exchange or ONLINE

Room 151’s LGPS Investment Forum

Our annual gathering of administering authorities of the LGPS, their investment pools and advisers.

Qualifying local government investment officers can register here.

In March 2021, The Times published the results from data compiled on local authorities’ burial space across the UK, which showed that the residual time period before their existing council-owned cemeteries are full to capacity was as follows:

- 17% have 5 years or less;

- 25% have 10 years or less;

- About 50% have 20 years or less.

At the same time, local authorities are also struggling to maintain standards in their crematoria provision. The increasing demand for cost-cutting in local council budgets means that councils are unable (note, not unwilling) to make the necessary investment to keep their sites competitive with private sector operators.

Furthermore, the recent CMA review of the sector was as critical of public sector price increases as it was of the private sector, putting further pressure on council finances which often rely on cremation fees as a key bulwark of their income.

Nevertheless, these bereavement services are a critical component of social infrastructure, as the pandemic has shown. We as a society need a properly funded, well managed “end of life” provision.

Furthermore, with the appropriate levels of investment and with a focus on operational excellence, such services can be managed to generate significant, predictable and sustainable income. As such, the sector represents a very attractive asset class for institutional investment: asset backed, income generating, un-correlated returns.

In response to these issues, in November 2018 Darwin Alternatives launched the Darwin Bereavement Services Fund. The fund’s strategy is to acquire and manage a portfolio of bereavement services assets to deliver sustainable, long-term, income for institutional investors.

Portfolio

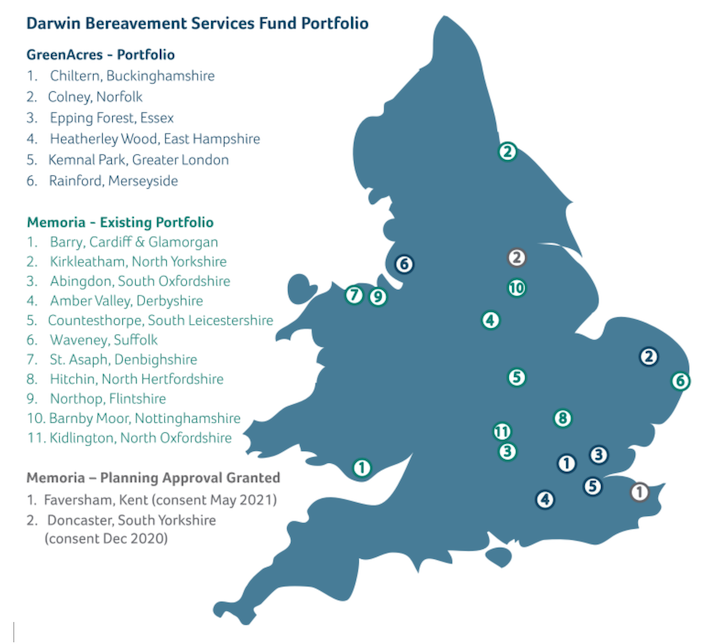

Since launch, the fund has acquired a portfolio of six high-quality and differentiated cemetery and woodland ceremonial parks in the UK, operated under the GreenAcres brand. In March 2020 the fund acquired CDS Group, a bereavement services consulting business focused on feasibility, planning and design of new crematoria and cemeteries and environmental management services.

Clients include over 100 local authorities and CDS is a key player in the Environmental Stewardship Group which was launched in late 2020 and aims to lead the bereavement sector to sustainability.

In May 2021, DBSF acquired the UK’s third largest developer and operator of private crematoria and memorial parks, Memoria Ltd, which operates 11 crematoria and burial grounds alongside Low Cost Funeral Ltd (LCF), who are the leader in the provision of on-line funerals and direct cremations.

Investment returns from death is clearly a sensitive subject for local authorities (as for any institutional investor) but DBSF aims to take pressure off local authority and church providers.

Its mission is to provide an exceptional service to bereaved families and to serve their communities compassionately with affordable and appropriate funeral care.

The modest target return of 6-8% per annum ensures that there is a focus on building a stable and sustainable business which benefits the community, rather than a desire to generate ever bigger profits. Ultimately, local authorities need stable income streams to meet their pension or spending liabilities, and investments in bereavement services can provide this as well as delivering an essential service to local communities.

DBSF Key Characteristics

Assets under Management £225.6m as at 30 June 2021.

Stable, long-term yield with target total return of 6 to 8% p.a.

Target cash yield of 6% p.a. for income units

James Penney is chairman of Darwin Alternative Investment Management Limited.

Photo by link bekka on Unsplash

—————

FREE monthly newsletters

Subscribe to Room151 Newsletters

Room151 Linkedin Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel