Published 2022/23 local authority draft accounts have shown a “significant” and “worrying” decrease in councils’ reserves, new data by consultant LGimprove has revealed.

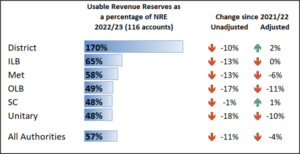

According to the analysis, based on the 116 local authorities who have published their 2022/23 draft accounts, usable revenue reserves have gone down by 11% over the last financial year. However, when you adjust this figure to remove the Covid-19 business rates relief councils’ received, reserves decreased by 4%.

It highlighted that in regard to reserve levels, there are massive discrepancies between authority types, with reserves for unitary and outer London borough authorities depleting by 18% and 17% respectively (without removing Covid-19 relief).

However, there were smaller reductions among county and district authorities, with their reserves decreasing by 1% and 10% respectively.

At an online webinar, Dan Bates, director at LGimprove, highlighted that the “significant” reduction in councils’ usable reserves is due to inflation and pressures caused by interest rate increases.

He said: “The majority of authorities’ reserves have depleted in 2022/23.

“It feels like we’re now starting to get to a point where reserves have peaked and they’re starting to come down. Often what you find is that reserves come down gently and then they come down more significantly. So, I would say that’s a really worrying position, certainly for some authorities.

“I think that the direction of travel, particularly for some authorities, is clearly not sustainable.”

Decreasing reserves shows ‘unsustainability’

Bates stated that revenue reserve levels are a “really important” part of councils’ financial health and when these start to diminish it is quite alarming.

“When we run out of those reserves, it can become a growing concern and I suppose that would take us to the section 114 territory.

“But, when reserves are running out it can show a number of other things, such as unsustainable budgets, unsustainable capital and unaffordable capital programmes etc,” he added.

The data by LGimprove also showed that School Balances and Housing Revenue Account reserves are also under “some real pressures” as they decreased by 6% and 8% respectively between 2021/22 and 2022/23.

Only 37% of councils have published accounts

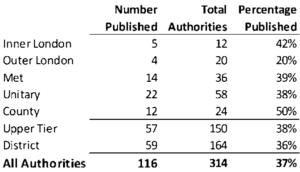

LGimprove’s analysis is based on the 116 out of 314 local authorities who have published their 2022/23 draft accounts, which is 37% of councils. The consultant also reported that 112 councils have published notices stating that their accounts will be delayed, with the main reason for this being “overhanging issues from 2021/22 accounts”.

Only 19% of local authorities have finalised their 2021/22 accounts, with 13% unpublished. The rest of the councils (69%) have published their draft 2021/22 audit.

Bates said: “At a time when there’s a lot of financial stress, it’s not great that we can’t see about two-thirds of the (2022/23) accounts.

“Also, if you look at all the authorities that we know have financial issues, such as Slough, Thurrock and Woking, they’re two to three years behind on their accounts.

“So, there is a bit of a correlation between the accounts that are published and the authorities possibly being under less financial stress.”

It is expected that the accounts that are submitted late are likely to be from authorities who are “struggling financially”. Hence, the overall picture of councils’ financial health is “likely to get worse” as more authorities publish their 2022/23 draft accounts, Bates added.

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

Growing DSG deficit

LGimprove’s data from the 2022/23 published draft accounts also showed that an increasing number of authorities are experiencing Dedicated Schools Grant (DSG) deficits, which is starting to “drag on their balance sheet health”.

Bates said: “One or two authorities seem to be adding to the earmarked reserve for DSG, which is still it’s still a statutory reserve. But, the majority of councils are now starting to build fairly big deficits that are going up year on year on year.

“And, I’m hearing a lot of people saying that they anticipate their DSG deficit to go higher and higher.”

The data also showed large reductions in pensions deficits as over the last financial year they had decreased by 84%. In fact, in aggregate, inner London boroughs and met authorities published in their accounts that they now have pension surpluses.

Bates said: “The change in pension deficit is massive, which I believe is due to a change in discount rates. This is consistent across all authorities, with the exception of two authorities where it doesn’t appear to have changed.”

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel