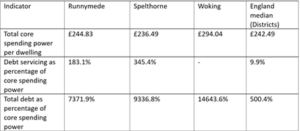

Figures from the government’s new Local Authority Data Explorer have revealed that Woking, Spelthorne and Runnymede Borough Councils’ total debt relative to core spending is astronomical compared to other authorities of their size.

The data found that Woking Borough Council’s total debt percentage of core spending power is 14643.6%. This is compared to a median percentage of 500.4% for other authorities in England of the same size. Albeit, these figures are to be expected as the authority issued a section 114 notice in June and is currently under government intervention due to its £1.8bn of debt.

Joining Woking at the top end of the spectrum are its neighbouring authorities of Spelthorne and Runnymede, with these councils’ total debt percentage of core spending power being 9336.8% and 7371.9% respectively.

This data was found using the Department for Levelling Up, Housing and Communities’ (DLUHC’s) Local Authority Data Explorer, which is part of the new Office for Local Government (Oflog) established on Wednesday (4 July).

Spelthorne’s £1.1bn debt

In the current financial year, Spelthorne Borough Council’s debt portfolio is valued at £1.1bn compared to its core spending power of £12.6m, according to statistics released by DLUHC.

The majority of Spelthorne’s debt comes from its investment in commercial assets, with its portfolio valued at £939.3m at 31 March 2022.

According to the council, its investments generate c£50m per annum and support £10m for authority services. However, in the last financial year, Spelthorne spent around £25m in interest payments to finance its debt, with the Oflog data suggesting that its debt servicing as a percentage of core spending is 345.4%.

‘Not the next Woking’

In comparison to Woking, Spelthorne’s debt is lower, but like Woking, the assets that the authority has invested in are commercial property. Property is an asset class which has faced a lot of headwinds in recent years and is expected to be largely challenged going into the future due to inflation and uncertainty around demand for office and retail space.

It was reported in May that Woking Borough Council faced a £490m write-down of its assets as the subsidiary company undertaking its commercial regeneration reported ‘devastating’ financial losses.

However, Spelthorne Borough Council stated that it has taken steps “to ensure that the commercial property programme is sustainable”, adding that its “investment model is very different to Woking”.

“Unlike other councils, we have always taken a cautious approach, paying down debt on a year-by-year basis,” the authority has said.

The council also outlined that it had set aside £37.8m (a Sinking Fund) to cover potential dips in commercial income.

Runnymede’s almost £650m debt

Just next door to Spelthorne, Runnymede Borough Council’s borrowing debt stood at £643.1m in Dec 2022, with a core spending power of £10m in 2023/24. The majority of Runnymede’s borrowing is from the Public Works Loan Board (PWLB) and was used to finance the authority’s regeneration schemes.

According to the council’s 2023/24 treasury management strategy, the interest payable on Runnymede’s debt will cost it over £16.7m, with the Oflog data suggesting that its debt servicing as a percentage of core spending is 183.1%.

The neighbouring borough councils of Elmbridge and Surrey Heath’s total debt percentage of core spending power is 355.5% and 1793.3% respectively, according to the data from DLUHC.

Room151 has contacted both Spelthorne and Runnymede Borough Councils for comment. However, they did not respond by the time of publication.

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

Data outside of Surrey

Data taken from the Local Authority Data Explorer also revealed that other borough councils outside of Surrey which have a high total debt as a percentage of core spending include Eastleigh and Warrington, at 4585.5% and 968.6% respectively.

It was reported in February that Eastleigh Borough Council’s net borrowing is anticipated to reach £607m at the end of the next financial year, with the interest payable on the council’s borrowing estimated to be £7.5m in 2022/23, and almost £15m in 2023/24.

In addition, Warrington Borough Council has a borrowing level of £1.8bn compared to a core spending power of £182m.

A Warrington Borough Council spokesperson told Room151: “This has been part of a strategic policy approach over the last few years to take advantage of the low-interest rate environment for the economic regeneration of Warrington.

“Warrington has adopted a prudent approach to this borrowing. The average length of our loan portfolio is 23 years, and we are currently sitting on £250m+ of PWLB premiums. After the prepayment of all debt costs, our portfolio generated a net return to the council of £23.4m in 2022/23.

“We have a strong balance sheet and look forward to the government publishing consultative indicators to provide a more meaningful interpretation of council accounts in the coming months.”

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel