Kent County Council has reported a £44.4m deficit in its budget for the last financial year, which it plans to bridge using wholly reserves.

A report by Zena Cooke, Kent’s corporate director of finance, outlined that due to increased spending pressures – associated with latent demand, increased complexity post-Covid-19 and rising inflation – the council has overspent its 2022/23 budget by £44.4m.

Cooke highlighted that the main departments where the authority has overspent are Children’s, Young People and Education and Adult Social Care and Health, with the areas exceeding their allotted budget by £32.7m and £24.4m respectively.

“The revenue estimates for the 2022/23 budget, approved in February 2022, were prepared against the backdrop of increased uncertainty and risk following recovery from the Covid-19 pandemic,” Cooke said in the report.

“Despite the additional spending growth allocated in 2022/23, the provisional revenue budget outturn position for 2022/23 is an overspend of £44.424m.”

Budget gap bridged with reserves

The report detailed that Kent’s overspend will be plugged using the council’s entire Risk Reserve, totalling £25m, while drawing down £22.1m from the General Fund Reserve for the remaining amount.

It stated that the council’s General Fund and Earmarked Reserves balance respectively stood at £37.6m and £317.5m as at 31 March 2023.

Cooke outlined in the report that both these reserves have seen a net reduction in the past year due to drawdowns to help fund the authority’s revenue outturn position.

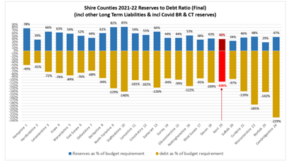

“On the face of it, Kent County Council’s resilience appears to have deteriorated in 2021/22 compared to other councils, particularly the levels of reserves as a proportion of the net revenue budget,” Cooke said.

However, she stated that the revenue outturn data from which this data is drawn is particularly complex and potentially inconsistent following the Covid-19 pandemic and the payment of grants intended to be used for more than one year.

It is therefore difficult to draw “meaningful conclusions” from the reserves to debt analysis due to different treatment of Covid-19 monies by individual authorities, Cooke explained.

She also stated that, according to CIPFA resilience measures of revenue spending, Kent’s ratio of social care spending compared to the rest of council services is average in relation to other county councils. But Kent is slightly lower on the levels of fees and charges as a proportion of revenue spending.

“Kent County Council reserves remain at the low end of the spectrum compared to other councils, even before the drawdowns to fund 2022/23 outturn, and we need to continue to take proactive steps as part of the annual review to ensure our reserves remain adequate,” Cooke added.

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

Council reserves decreased by 11% last year

According to the analysis, based on 116 local authorities who had published their 2022/23 draft accounts, usable revenue reserves went down by 11% over the last financial year. However, when this figure is adjusted to remove the Covid-19 business rates relief that councils’ received, reserves decreased by 4%.

It also highlighted that in regard to reserve levels, there are massive discrepancies between authority types, with reserves for unitary and outer London borough authorities depleting by 18% and 17% respectively (without removing Covid-19 relief).

However, there were smaller reductions among county and district authorities, with their reserves decreasing by 1% and 10% respectively.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel